According to Forrester, typical B2B customer retention rates are between 76% and 81%. The average mobile app retains less than 5% of its users after 30 days. This is where customer churn prediction is needed. Customer churn prediction uses machine learning to predict when customers will cancel their membership, or regular customers will stop shopping. According to old research from Bain & Company, a 5% increase in customer retention can increase profits by 25% to 95%. Unfortunately, reliably predicting customer churn is as challenging as it is valuable.

This article will define customer churn prediction, discuss the methods that can be used for it, and explain the challenges.

Key points

- What is a churn prediction?

- What are the benefits of customer churn prediction?

- What ML methods are used in customer churn prediction?

- What data can be used for customer churn prediction?

- Customer churn prediction challenges

- Churn prediction use cases

- How does SoloWay Tech help optimize ROI and convert more customers?

- Conclusion

What is a churn prediction?

Customer churn is the ongoing process of individual customers abandoning the purchase of a company’s goods or services. For example, take any company that maintains recurring customer relationships: Netflix, Amazon, or any B2B retailer. Once you have customers who have purchased from the company multiple times or maintain a membership, they are considered returning or loyal customers.

Recurring customers have the advantage that you can better play them with marketing measures, and they bring a certain reliability to sales planning, especially with subscription models like Netflix. Acquiring new customers costs 5 to 10 times more than selling to a current customer — and current customers spend 67% more on average than those new to your business. Therefore, companies need to know how many returning customers will churn to control company processes and initiate countermeasures for each customer.

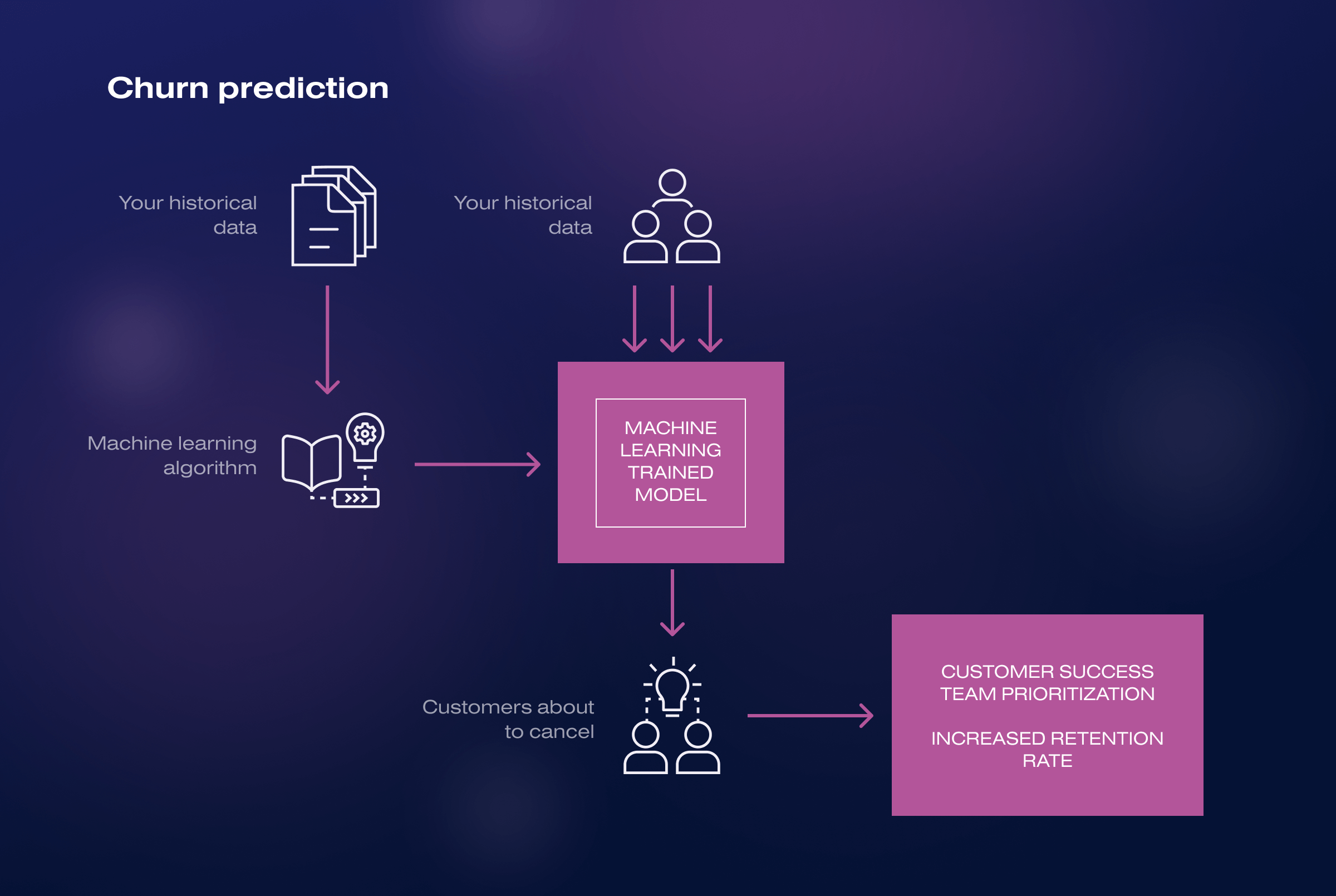

Customer churn prediction involves using statistical modeling (machine learning on Big Data) to calculate how many customers are at risk of not returning in the coming period (month or quarter). More advanced analytics also identifies exactly which customers fall into this category, for example, to have them contacted by support staff.

What are the benefits of customer churn prediction?

Returning customers or loyal subscribers are valuable to a company. They do not cost any more money in acquisition (e.g., targeted advertising, AdWords, vouchers). You can already analyze their behavior and, thus, their preferences. And they provide reliable sales planning due to often cyclical purchasing behavior, especially with monthly requirements and/or fixed billing periods.

The customer churn rate is an essential issue in the processes organization within a company. You can manage the situation by predicting how much minimum churn rate a company can expect in the next few months. Whether it’s supplier conditions, service staff, or recruiting, all operational aspects are linked to a company’s sales chain and can be better planned.

Since prediction can be used to determine with customer precision who is likely to churn from the company, this information can be used to take countermeasures. Whether a coupon or a customized offer, the opportunities to keep user increase.

2 other aspects are often overlooked when a company implements a churn prediction project. Depending on the AI used, you can predict the “if” and the “when” of a customer churn. This information is excellent for new customer acquisition or customer management. If you know the probability that a customer will stay with the company for a long time, you can invest in this customer accordingly.

Depending on the machine learning model, it is also possible to use the algorithms to identify which factors have a major effect on customer churn (e.g., age, gender, number of products purchased, etc.) and which do not (e.g., location, time of year, etc.).

What ML methods are used in customer churn prediction?

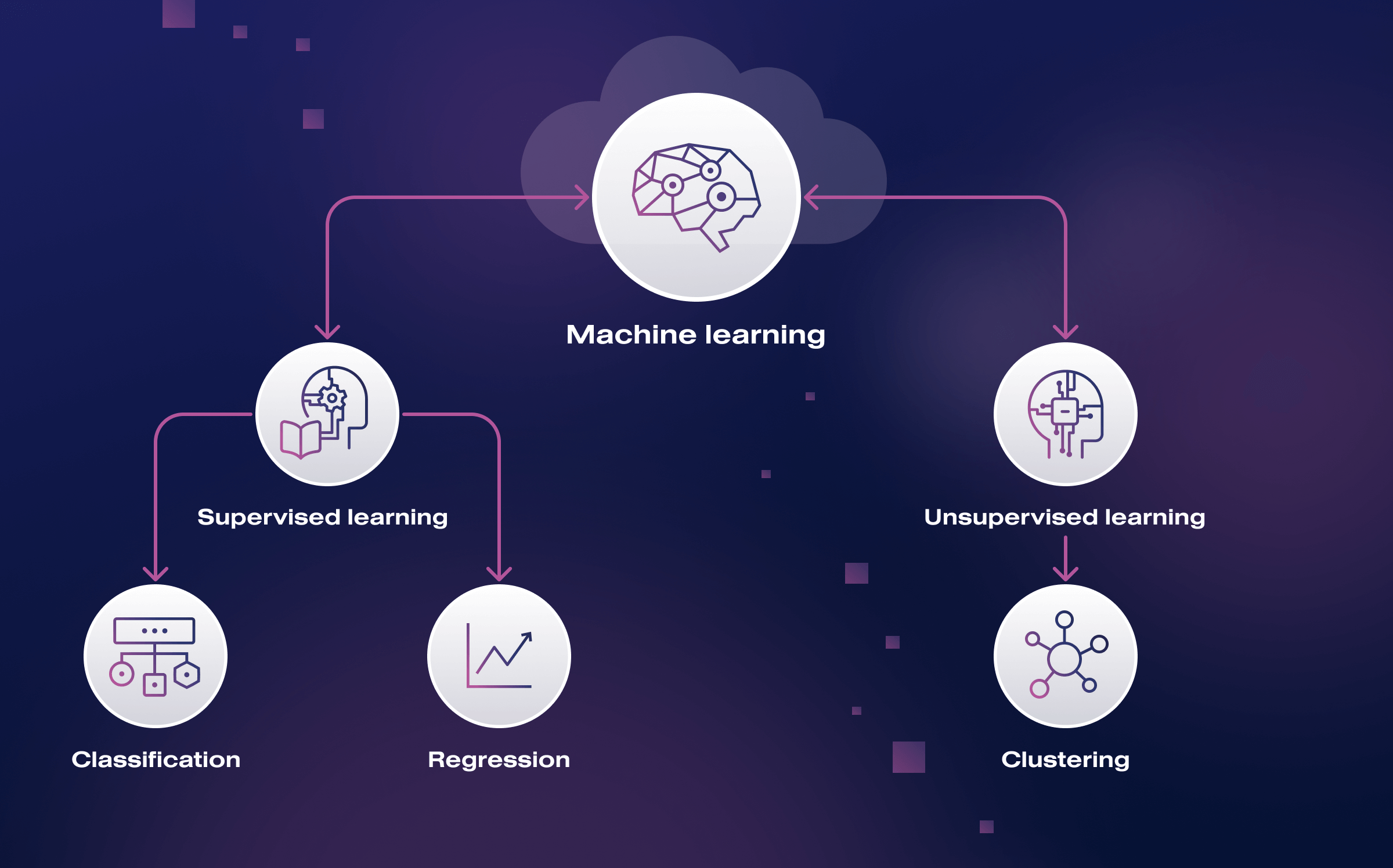

Customer churn prediction is a title for a use case within Data Science or Machine Learning (ML). Therefore, supervised machine learning methods are mostly used here. These methods use existing information (for example, information about which customers have already left/stopped buying/canceled) and calculate a statistical model that is as realistic as possible.

Two types of supervised machine learning algorithms are often used for customer churn. Classification algorithms are used if you only want to predict the “if” or want to make a binary prediction (yes/no or churn/no churn). These classifiers (for example, logistic regression, neural networks/deep learning, random forests) assign new data records (for example, a customer who has been a regular customer) to a category (churn/regular customer) according to the model.

The other group of methods falls into the area of regression. The regression algorithms predict numerical values, i.e., the duration of recurring payments. Suppose you want to evaluate how likely your customer will remain for a long time when you sign a contract (to offer appropriate terms if necessary). In that case, a regression can estimate how many months or years he or she will stay with the company.

While supervised machine learning is definitely at the core of churn prediction, other algorithms can also be used. Great examples are simple descriptive data analysis for exploratory analysis, unsupervised machine learning to identify customer groups, reinforcement learning (RL), etc.

What data can be used for customer churn prediction?

A whole range of data can be used for customer churn prediction. As usual in machine learning, the recommendation is to first get an overview and then generously exclude data sources using feature engineering and feature selection. Here are a few suggestions on what data can be used to predict customer churn:

- Customer management system (CMS) data. The best repository of data for customer churn is the CMS. The customer management system should have all the master data around a customer stored and associated with their ID: gender, age, email, length of membership/date of first purchase.

- Transaction data. Customer master data alone usually contains only part of the information about what interests a customer. A large other part usually comes from transactional data, whether e-commerce store, enterprise resource planning (ERP) system, or other.

- Product data. Whether PIM or MDM, information about the products purchased can provide outstanding conclusions about which customer group is involved and whether a long-term relationship is possible.

- Tech support data. Unsurprisingly, contact with tech support is often made shortly before a customer churns. Therefore, tech support data in as much detail as possible is an excellent contribution to the accuracy of the churn prediction model.

- Promotional data. If you record your marketing data and thus all promotions cleanly in a system, you can understand which customer purchased based on which advertising. Often, these are one-time customers who have only bought due to an outstanding promotion, and then it is challenging to convert them into regular customers.

- Web analytics. Clean tracking in web analytics makes tracking customer behavior on the website possible. This is an excellent input for many models to optimize churn prediction.

- Newsletter data. Those who interact positively with the company are typically more likely to be positive toward the organization. Consequently, newsletter interactions are often a signal of long-term customer relationships.

- Geographic and socio-demographic data. Where customers live, how old they are, and what demographic they come from often allows us to optimize churn prediction.

Of course, there are many more data sources that support the accuracy of customer churn prediction. Therefore, every company needs to perform a comprehensive data inventory and thus define the potential for churn analyses.

Customer churn prediction challenges

Of course, the customer churn prediction is not a panacea. Even with the best prediction, there are challenges. The simplest example is probably a bad prediction. If you try to keep customers without intending to leave the company, you may incur unnecessary expenses. Data quality also plays a major role here. The prediction quality can be correspondingly high only if you use high-quality data.

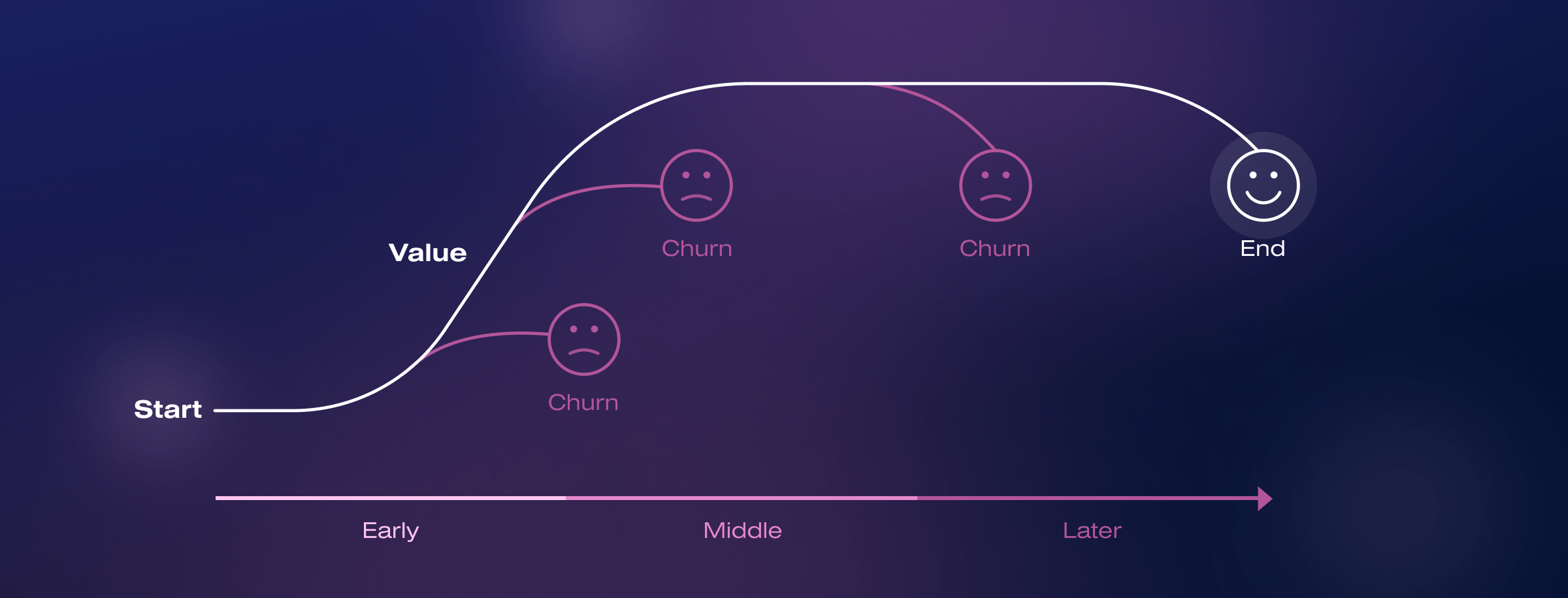

A second challenge is that it may already be too late when potential customer churn is detected. Retaining these customers may be impossible if all behavioral signs are already on the course of cancellation or churn. Consequently, all the effort into these activities would also be wasted.

A third challenge is that it is quickly communicated if a standard retention process is applied uniformly to all at-risk customers (for example, 2 monthly subscriptions free of charge). As a result, many customers take advantage of this process by specifically triggering it, even though they may not have even intended to churn.

Despite these disadvantages, many companies still see customer churn prediction as a precious tool for building data-based knowledge about their customers. How this tool is used must be worked out very meticulously but also creatively.

Churn prediction use cases

Here are some real companies that have implemented churn prediction in their operations:

- Telefónica. This multinational telecommunications company uses churn prediction to identify customers likely to switch to a competitor. By analyzing customer usage patterns, call data records, billing information, and customer interactions, Telefónica implements targeted retention strategies to reduce churn and improve customer loyalty.

- Amazon. This e-commerce giant employs churn prediction to retain customers on its platform. By analyzing customer purchase history, browsing behavior, product reviews, and customer feedback, Amazon provides personalized recommendations, targeted offers, and enhanced customer service to mitigate churn and encourage repeat purchases.

- Spotify. This popular music streaming service identify users likely to churn. By analyzing user listening habits, playlist creation, and user engagement metrics, Spotify offers personalized playlists, curated content, and special promotions to keep users engaged and prevent churn.

These are just a few examples of real companies that have successfully implemented churn prediction in their operations. Churn prediction has become a widely adopted practice across industries to enhance customer retention and improve business performance. AI provides especially great possibilities for e-commerce than any other modern technology.

How does SoloWay Tech help optimize ROI and convert more customers?

Our team can provide churn prediction development services to businesses across various industries. Our available workforce allows us to scale up quickly, while organized Soloway processes allow you to start working on the customer churn prediction project almost immediately. We can do the following:

- Data analysis and preparation

- ML model selection and development

- Feature engineering and selection

- Model training and evaluation

- Ongoing support and optimization

We have over 14 years of diverse expertise as well as experience in customer churn prediction development. Feel free to contact us today to discuss your ideas!

Conclusion

The most beautiful metaphor for a high customer churn rate is the bucket with holes. You keep pouring water in at the top, but the bucket empties quickly, no matter how hard you try. Customer churn prediction tries to address this problem by examining how big the holes are and where they are located, but you still have to fix them.

Customer churn prediction is a classic use case for artificial intelligence (AI), which can be used as a valuable and efficient tool. After all, regular customers are loyal customers. And loyal customers allow a company to be successful in the long run.