The financial advisory landscape is evolving at an unprecedented pace. In an industry where client trust, compliance, and personalized service are paramount, customer relationship management (CRM) has emerged as an indispensable tool for success. CRM systems have revolutionized how financial advisors interact with clients, manage practices, and adapt to the changing regulatory environment.

This article discusses what CRM for financial advisors is, must-have features for CRM systems for financial advisors, and a list of CRM Systems with Open APIs.

Key points

What is CRM for financial advisors?

For financial advisors, the ability to enhance their client roster and foster enduring, more lucrative connections is paramount. Achieving this involves the adept utilization of a Customer Relationship Management (CRM) system.

By harnessing the power of CRM systems, advisors can efficiently expand their outreach, allocate resources wisely, and pinpoint fresh avenues for growth. These data-centric tools ensure advisors have essential information readily accessible, streamlining the process of nurturing relationships with clients and prospects while efficiently advancing them through the sales pipeline.

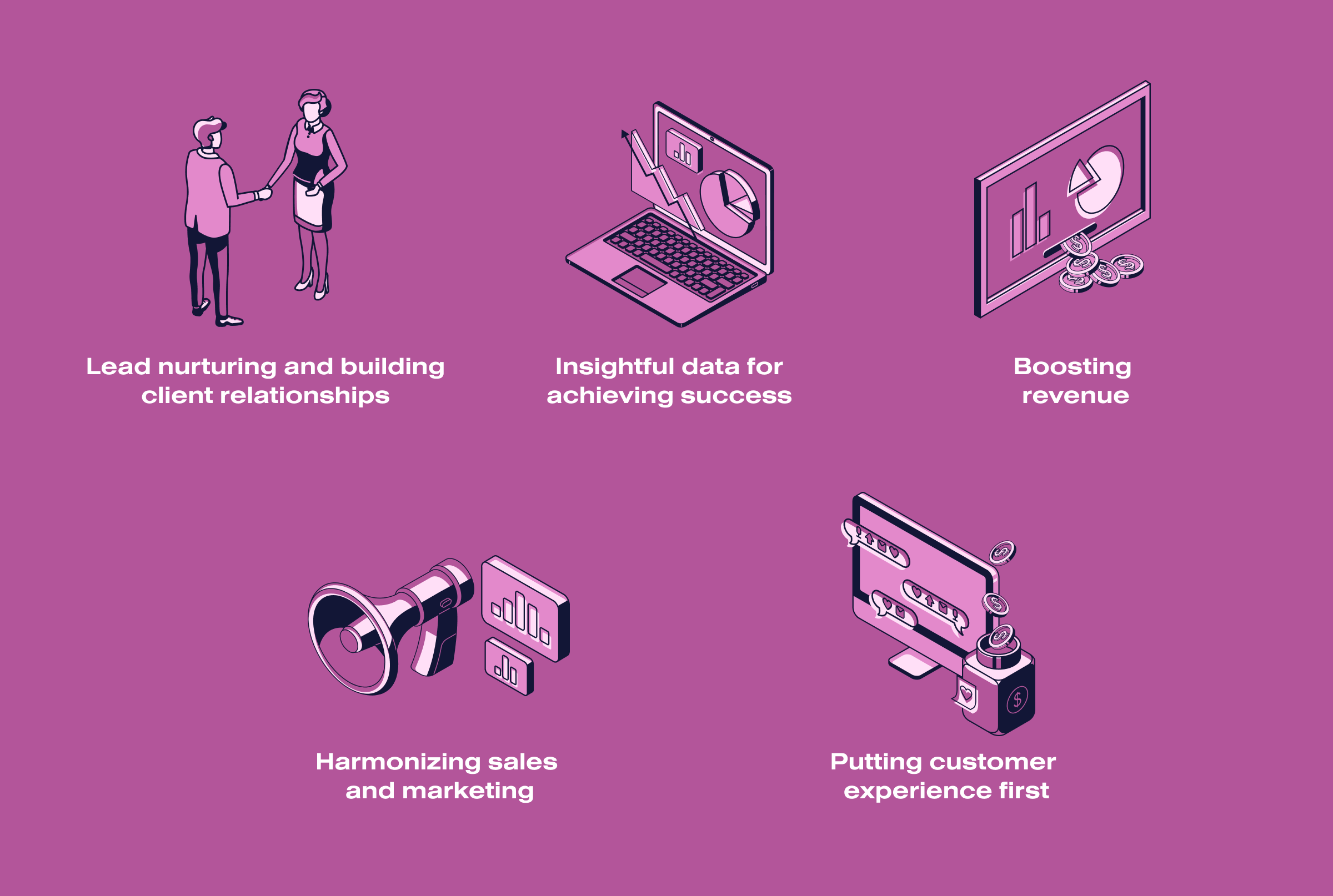

Why do financial advisors need CRM?

Financial advisors need a Customer Relationship Management (CRM) system for five reasons.

Lead nurturing and building client relationships

In financial advisory, the focus is on generating leads and fostering enduring client connections. This is where CRM software steps in as the indispensable tool for tracking your networking endeavors. A reliable CRM doesn’t just help you gather data; it empowers you to nurture relationships.

It aids in maintaining a detailed engagement history and allows personalized notes to remember the specifics of your initial connections. It keeps you in sync with your client’s evolving needs and objectives and guides gently moving leads through your sales pipeline. CRM is a steadfast companion for effective long-term client management.

Insightful data for achieving success

The cream of the crop among CRM solutions for financial advisors often comes equipped with robust business analytics. Your network of client relationships forms a rich tapestry of data.

Financial services CRM doesn’t merely keep tabs on your in-house network; it opens doors to a wealth of broader financial data. This community-sourced information and intelligence provide actionable insights that benefit not only your existing clients but also pique the interest of potential ones.

Boosting revenue

As an experienced financial advisor, you understand your success is intrinsically tied to your clients’ financial well-being. Your core objective is to enhance your clients’ financial portfolios. This is where CRM solutions tailored for advisory firms truly shine.

They streamline task management, freeing up time previously spent on mundane activities. This time-saving enables you to focus on in-depth financial research and the pivotal task of cultivating those crucial client relationships. Essentially, they serve as your organizational wizards, ensuring you’re always at the top of your game and never miss out on promising opportunities.

Harmonizing sales and marketing

Running a successful financial practice involves managing various moving parts, with sales and marketing at the forefront. Elevating your brand necessitates strategic initiatives like email marketing and engaging with clients on social media. When your marketing strategies bear fruit, your sales team must be ready to engage with incoming prospects. CRMs are pivotal in unifying these facets, ensuring your sales teams are well-prepared and informed.

Putting customer experience first

The relationship between a financial advisor and a client transcends one-time transactions; it’s a long-lasting connection. Follow-ups are pivotal, and a high-quality CRM for financial advisors ensures clients have easy access to responsive customer support, whether in times of prosperity or adversity.

An array of issues may arise, spanning technical support to evolving client needs, and your CRM equips you to make informed decisions. Despite unexpected challenges, clients can always rely on their financial advisors for exceptional support.

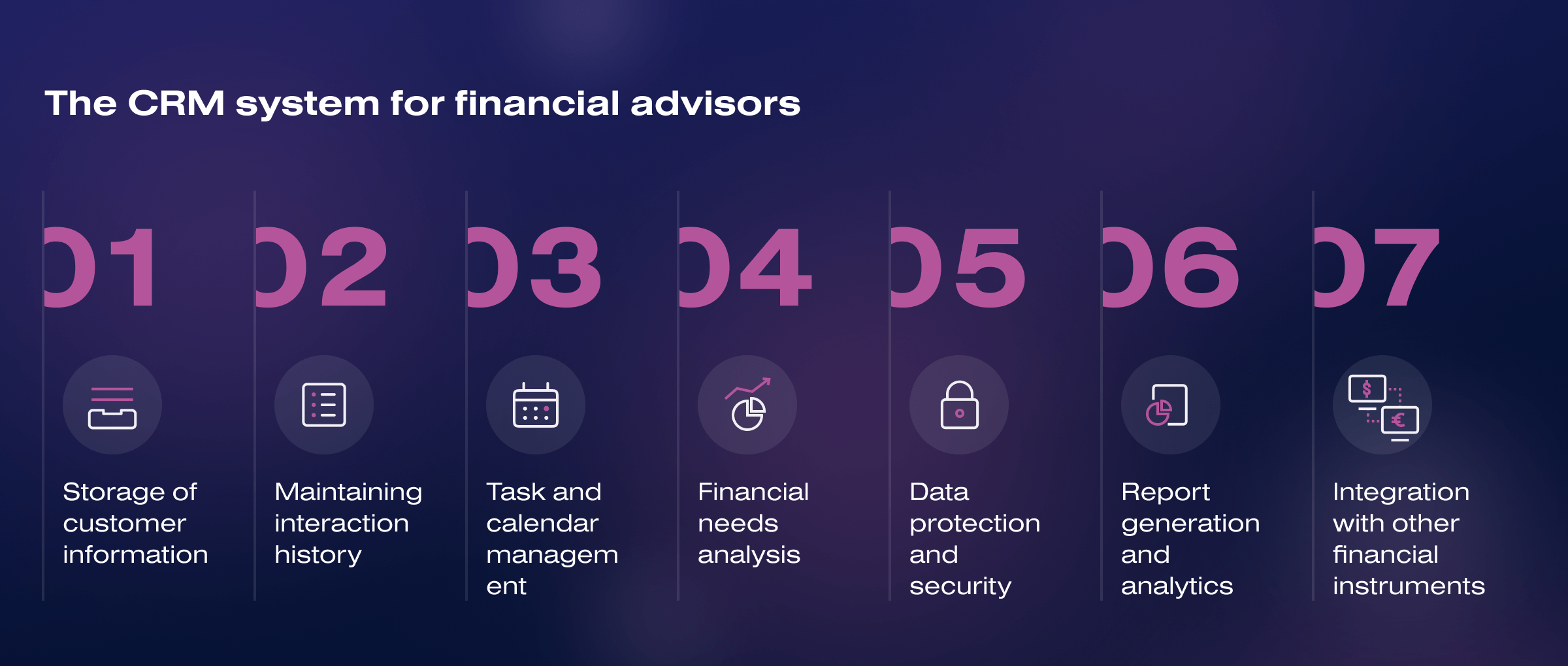

Must-have features of the CRM system for financial advisors

Below is a list of must-have features for CRM systems for financial advisors:

- Storage of customer information. CRM for financial advisors should be able to store complete customer information, including contact details, interaction history, and financial status.

- Maintaining interaction history. CRM should allow you to record all customer interactions, such as phone calls, emails, and face-to-face meetings.

- Task and calendar management. CRM for financial advisors should provide the ability to schedule appointments, events, tasks, and reminders of their deadlines.

- Financial needs analysis. CRM systems for financial advisors should help analyze clients’ financial situation, including income, expenses, investments, and retirement plans.

- Data protection and security. CRM for financial advisors should provide high protection for confidential customer information and comply with data protection requirements.

- Report generation and analytics. CRM for financial advisors should allow you to generate financial reports and analyze data for decision-making and strategy planning.

- Integration with other financial instruments. CRM should be able to integrate with other financial applications and tools, such as accounting systems and investment platforms.

These features help financial advisors store and analyze client information, plan and execute tasks, provide a high level of service, and facilitate the efficient management of clients’ financial assets.

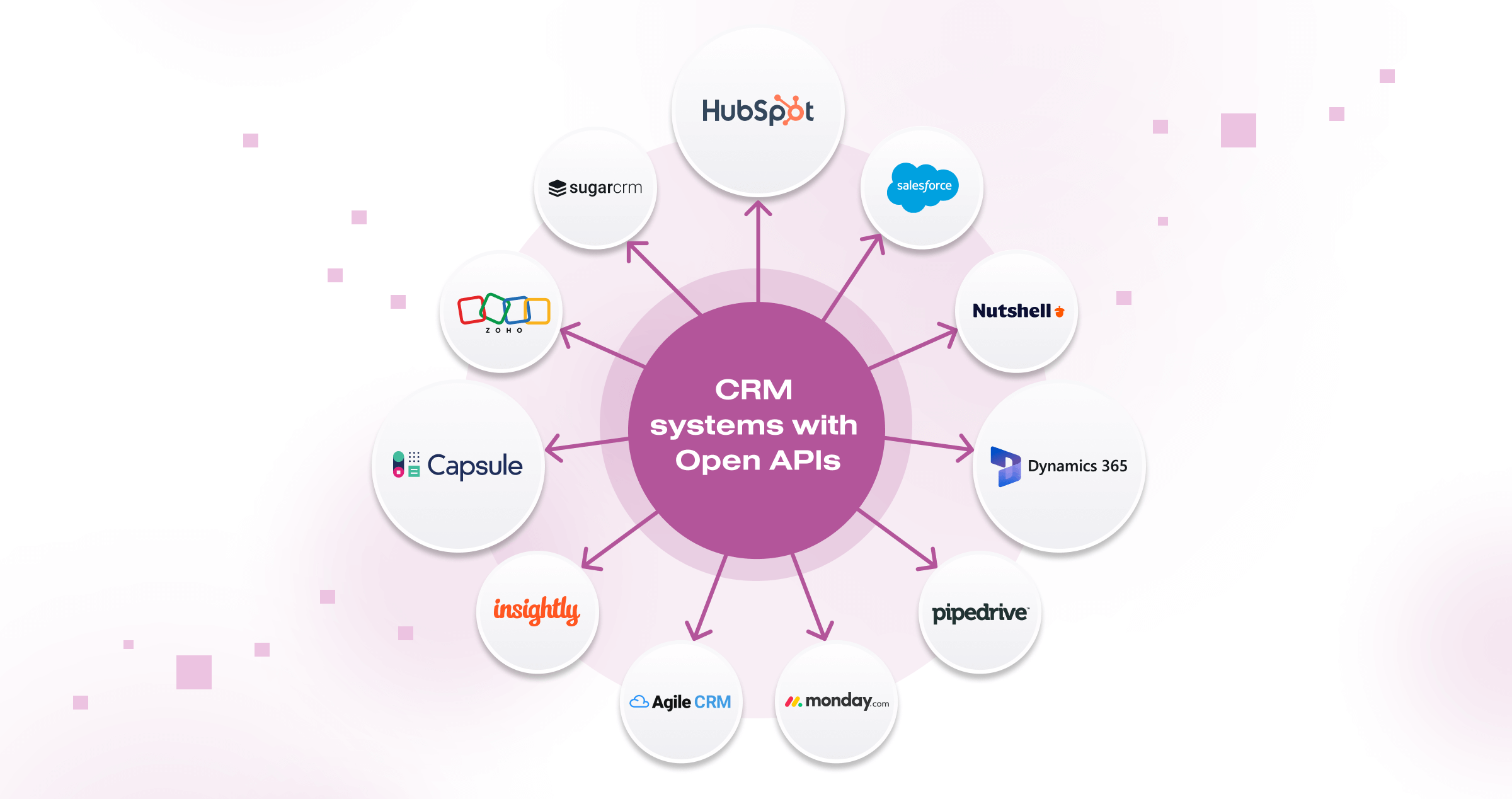

List of CRM systems with Open APIs: your path to customization

Access to open APIs can be a game-changer for customization and integration with other tools. Here’s a list of CRM systems known for their open APIs:

- Salesforce

- HubSpot

- Zoho CRM

- Microsoft Dynamics 365

- SugarCRM

- Pipedrive

- Monday

- Insightly

- Capsule CRM

- Nutshell

- Agile CRM

These CRM systems with open APIs empower you to create a tailored CRM experience, integrate with your existing software stack, and streamline your business processes for improved efficiency and productivity.

How can SoloWay Tech help you improve customer service with a CRM that fits your business?

Our SoloWay Tech team consists of renowned software developers from Ukraine with experience in over 10 industries. We worked with projects in the following industries: financial services, eCommerce, manufacturing, eLearning, real estate, hospitality, and more. Here are 5 basic ways we can be helpful to you:

- Custom CRM development. Our team at SoloWay Tech can create a CRM system completely tailored to your business requirements. This ensures that the CRM is designed to align seamlessly with your specific customer service processes and needs.

- Integration. We can integrate the CRM with your existing systems and software, ensuring a smooth transition without disrupting your current operations. This integration can help streamline data sharing and accessibility, making it easier to deliver excellent customer service.

- Scalability. As your financial business grows, our SoloWay Tech team can expand and adapt the CRM system to accommodate your evolving demands. This scalability ensures that the CRM remains an effective tool over time.

- Data security. As a software development company, we can implement robust data security measures within the CRM, safeguarding customer information and maintaining compliance with data protection regulations.

- Upgrades and maintenance. Our team can provide ongoing support, including regular updates and maintenance, to keep the CRM running smoothly and securely.

Feel free to leverage our expertise as a development company! This way, you can ensure that your CRM system is not just a standard off-the-shelf solution but a tailored, powerful tool for enhancing your operations.

Conclusion

Customer relationship management (CRM) is an indispensable tool for financial advisors looking to thrive in an increasingly competitive and regulated industry. By adopting a robust CRM system, financial advisors can effectively manage client relationships, enhance client retention, streamline operational processes, and gain valuable insights into their business.