According to a PYMNTS study, nearly 2 out of 3 major banks (62%) report increased financial crime. Losses are reaching billions of dollars, and brands are experiencing severe reputational damage. Therefore, they attract all possible tools to combat fraudsters, particularly machine learning (ML).

In our article, you will find out what fraud detection and machine learning are, as well as what’s the difference between AI and ML. We’ll also show you ML use cases for fraud detection in e-commerce, government, banking & finance, and healthcare.

Key points

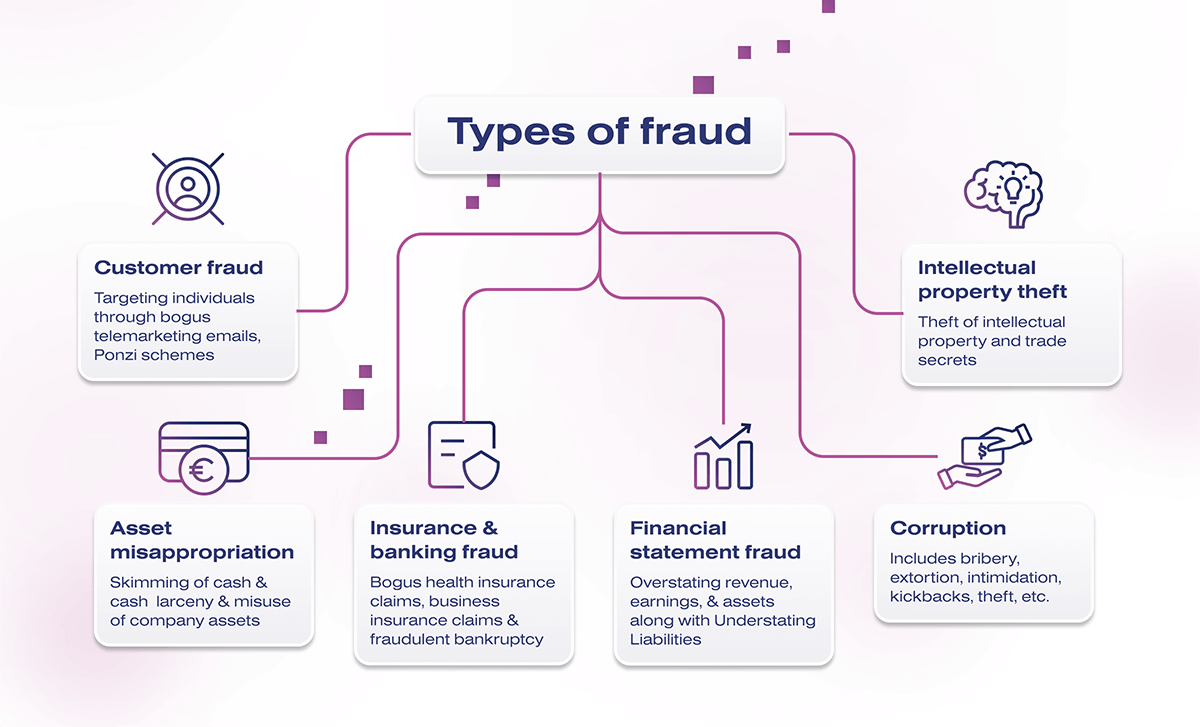

What is fraud detection?

According to The State of Fraud And Financial Crime In the U.S. study, financial institutions with more than $5 billion in assets lost about $120 million in 2022 due to the high intensity of targeted attacks. Avast released the Q4/2022 Threat Report, which states increased cybercrime, so-called “zero-day vulnerabilities” in Google Chrome and Windows, and the massive spread of malware to steal information, particularly Trojans.

Fraud detection is a software or hardware-software complex that monitors, detects, and manages fraud. Fraud detection must be necessarily set up for banks, telecom operators, payment systems, and other domains. Most often, machine learning algorithms are used for identifying fraud.

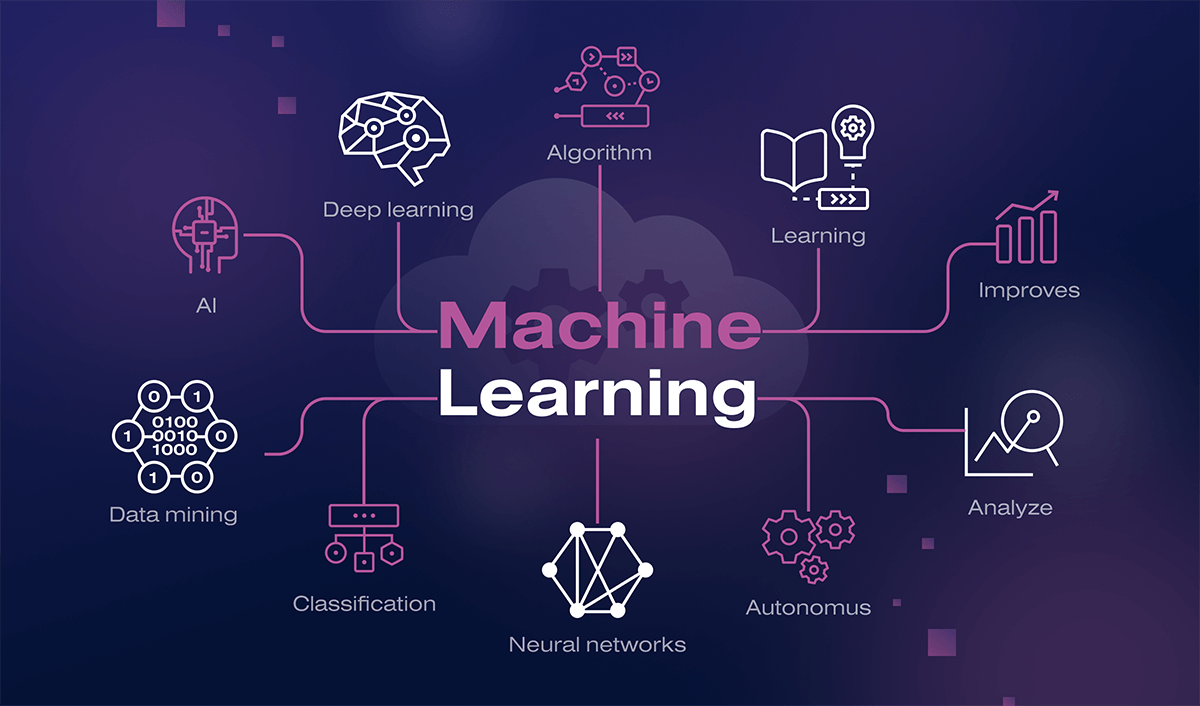

What is machine learning?

Machine learning is a field that allows for building teachable models for a variety of purposes, such as process automation, automatic text translation, image recognition, fraud detection, etc. For example, machine learning helps rank content in social media feeds and create chatbots.

There are two types of machine learning: deductive and inductive.

In the case of deductive learning, the tasks are formulated and have formalized knowledge. For example, it may be a database that states that if the bank account has over 30 transactions per day, you should check it for fraud. But it needs to derive new rules that can be applied to a particular case.

Inductive machine learning is subdivided into:

- Supervised learning. Example task: predict the exchange rate for tomorrow based on the previous exchange rate.

- Unsupervised learning. Example task: divide a group of bank users based on their interests or demographics.

- Reinforcement learning. Example: the game Super Mario, in which the computer (person) interacts with the environment (game level) and receives positive or negative points.

- Active learning. Example: word prompting on a phone keypad.

Many methods of inductive machine learning involve information extraction.

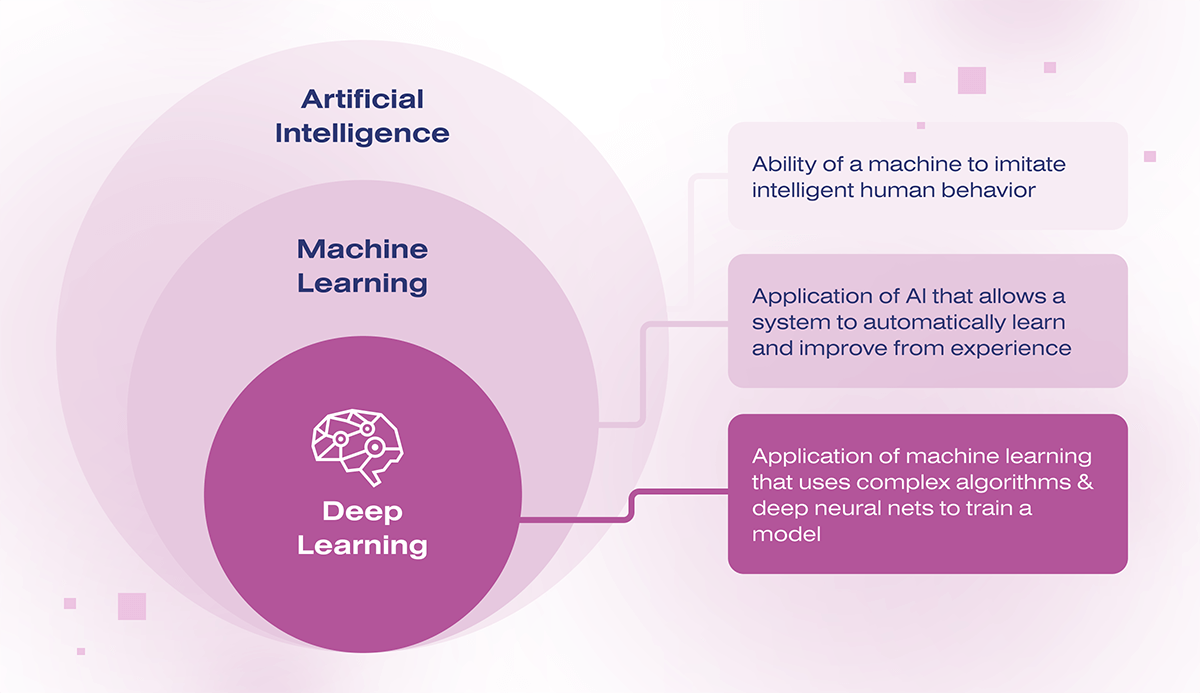

What’s the difference between artificial intelligence and machine learning?

All tasks a human or computer can solve can be divided into routine and non-routine.

Routine tasks are where it is easy to find a universal solution: adding numbers or measuring the air temperature. This is where ML can be used.

Artificial Intelligence (AI) is now commonly referred to as anything that can solve non-routine tasks at a level close to humans or sometimes better. Such tasks are all around us. Traffic cameras calculate the speed of a car, recognize its car number plate and send a fine. Security systems in subways and airports find criminals in crowds.

AI is not a single algorithm’s name but a group of methods for solving different problems. Machine learning algorithms are only one subset of the whole set of algorithms, commonly called artificial intelligence.

Examples of machine learning use cases in fraud detection

We have gathered 20 real use cases of using ML for fraud detection in different domains.

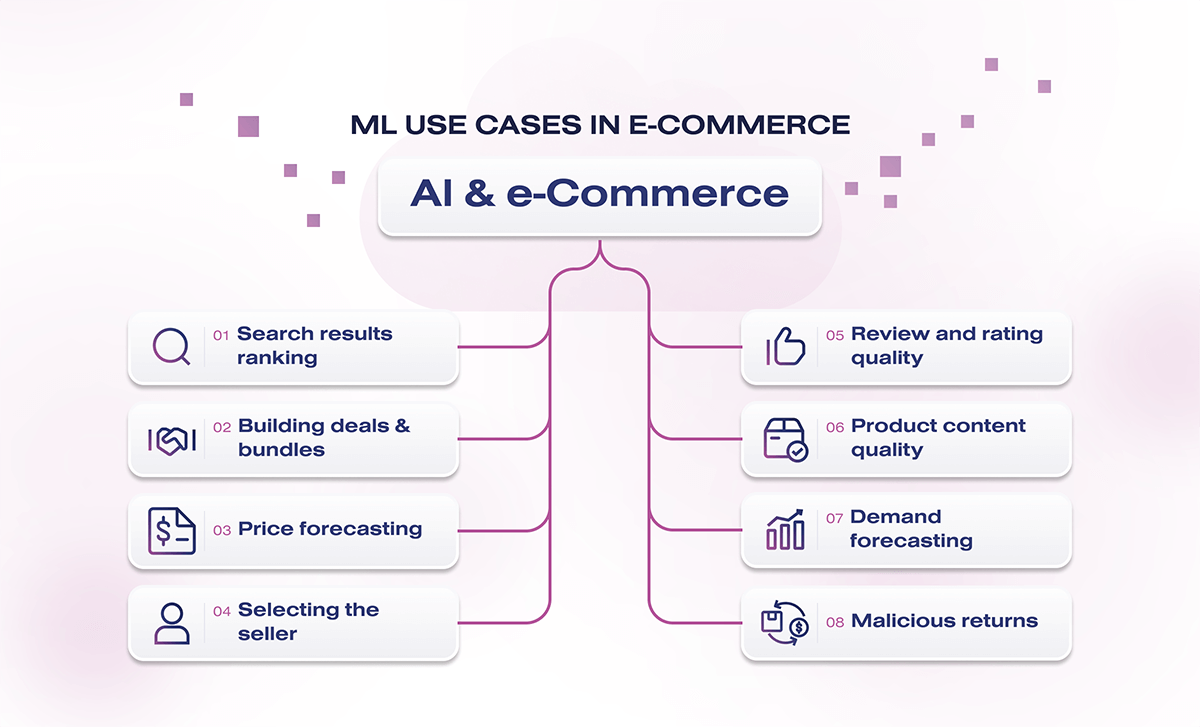

Fraud detection in e-commerce with ML

Real-world examples of machine learning use cases in fraud detection for e-commerce:

- PayPal. It uses ML algorithms to analyze transactions and detect potential fraud. ML algorithms look at factors such as the location of the transaction, the device used, and the user’s past behavior to determine whether a transaction is likely fraudulent.

- Amazon. It uses ML algorithms to detect fraudulent reviews. Their algorithms analyze factors such as the language used in reviews, the reviewer’s behavior, and the review’s timing to identify reviews that are likely to be fraudulent.

- Alibaba. It uses ML algorithms to detect fraudulent sellers. ML algorithms analyze factors such as the number and types of products sold, the seller’s behavior, and the seller’s ratings to determine whether a seller is likely to be fraudulent.

- Shopify. It uses ML algorithms to detect fraudulent transactions on its platform. ML algorithms look at factors such as the location of the transaction, the device used, and the user’s past behavior to determine whether a transaction is likely fraudulent.

- Mercado Libre. This popular e-commerce platform in Latin America detects fraudulent sellers and buyers using ML. Their algorithms analyze factors such as the seller’s behavior, the buyer’s behavior, and the product characteristics to identify potential fraud.

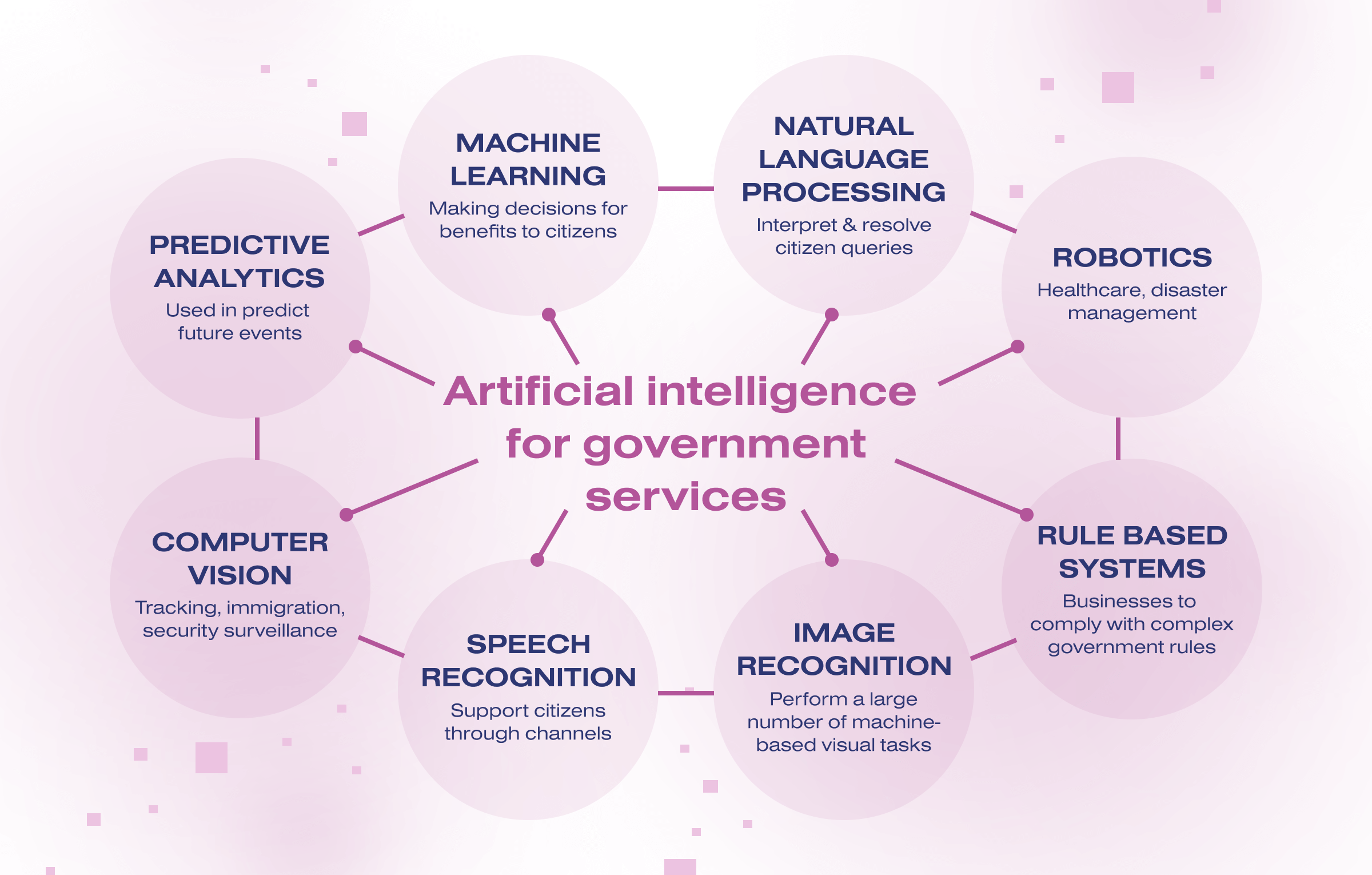

Fraud detection in government with ML

Real-world ML fraud detection use cases in different governments:

- Tax Evasion Detection in the US. IRS uses machine learning to detect fraudulent tax returns. The machine learning algorithms analyze large amounts of data, including income, deductions, and past tax history, to flag suspicious returns.

- Social Welfare Fraud Detection in the UK. The UK government detects fraudulent claims for social welfare benefits using machine learning. Data analytics and pattern recognition are used to identify unusual behavior patterns or fraudulent claims.

- Healthcare Fraud Detection in Australia. The Australian government uses machine learning to detect fraudulent claims in the healthcare system. Large amounts of data are analyzed, including medical records, billing information, and claims history.

- Immigration Fraud Detection in Canada. The Canadian government uses machine learning to detect fraudulent immigration applications. The system analyzes and compares application data to past applications to identify suspicious patterns or inconsistencies.

- Voter Fraud Detection in India. The Indian government uses ML to detect voter fraud in elections. It analyzes voter data and compares it to other data sources, such as biometric data.

Governments worldwide are applying innovations to optimize and improve their work. And ML is one of many such innovations.

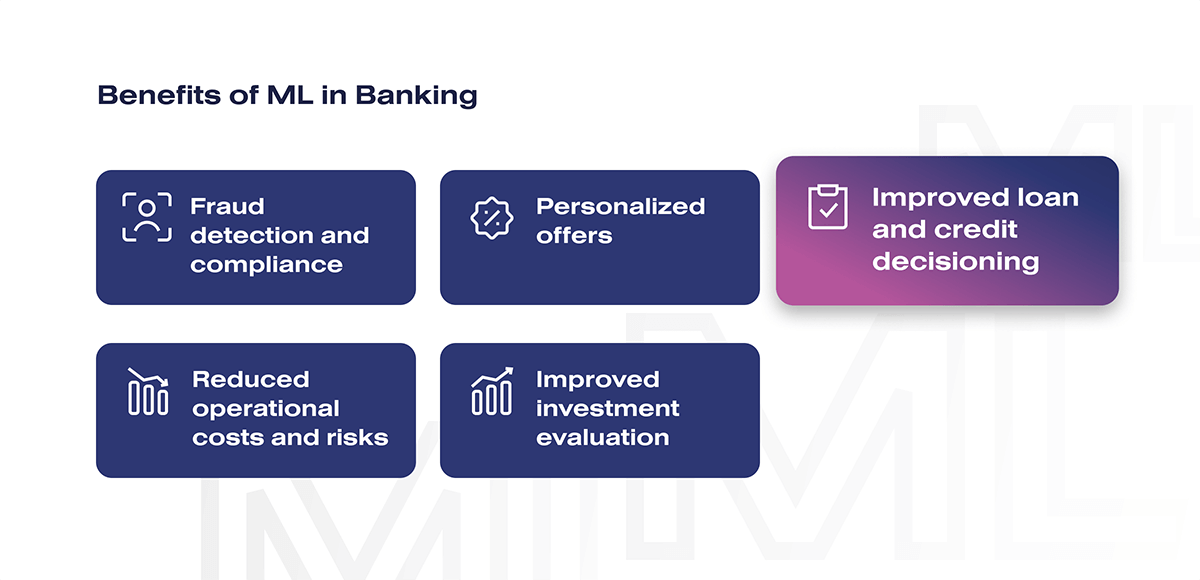

Fraud detection in banking and finance with ML

Real-world examples of how banks use machine learning (ML) in fraud detection:

- JPMorgan Chase. This bank uses anomaly detection algorithms to flag unusual transactions or activities that do not fit the customer’s profile. It also uses NLP to analyze customer interactions and identify potential fraud.

- Capital One. This American bank holding company uses deep learning algorithms to analyze checks and identify potential fraud cases, such as forged signatures, altered amounts, and counterfeit checks. The deep learning models are trained on vast amounts of historical data to identify patterns and anomalies that suggest fraud.

- Citibank. It uses machine learning algorithms to identify potential fraud rings by analyzing behavior patterns across multiple accounts. Algorithms can detect connections between seemingly unrelated accounts that suggest a fraudulent activity, such as shared IP addresses, devices, or addresses.

- Bank of America. The bank’s ML algorithms can detect patterns of behavior that suggest a fraudulent activity, such as transactions that occur outside the customer’s normal spending habits or patterns.

- American Express. Its ML algorithms can analyze millions of transactions per second and identify suspicious behavior patterns, such as multiple transactions in quick succession or transactions at unusual times. This American multinational financial services corporation also uses unsupervised learning algorithms to identify new and emerging fraud patterns that may not have been seen before.

If you need a reliable ML partner, you are free to contact SoloWay Technologies.

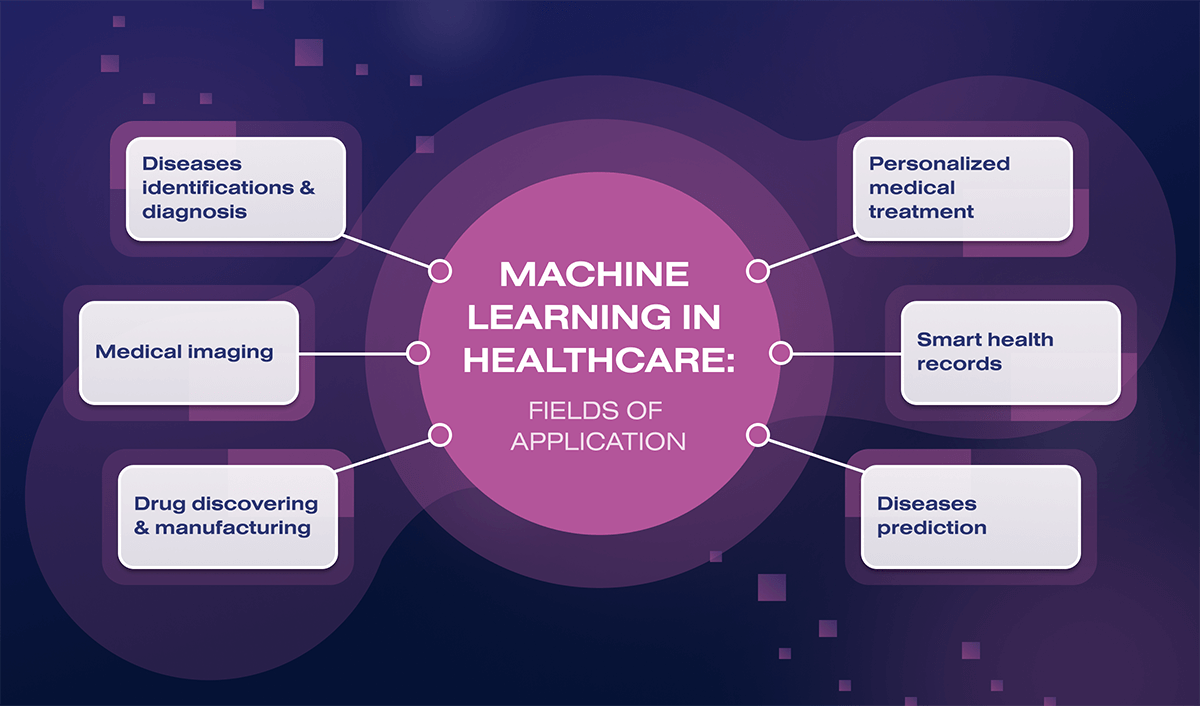

Fraud detection in healthcare with ML

Examples of how machine learning is used for fraud detection in the healthcare domain:

- UnitedHealth Group. It uses ML algorithms to detect fraudulent insurance claims. Their system analyzes data from multiple sources, including claims, provider, and member data.

- Anthem. It uses ML to detect medical identity theft. Their system analyzes patient data, such as medical history and prescription records, to identify inconsistencies and suspicious activity.

- Optum. It uses ML to analyze medical claims data and identify patterns of fraud. They use advanced analytics and predictive modeling to identify high-risk providers and patients.

- Humana. It uses ML algorithms to analyze potential identify fraud. Their system uses rule-based and predictive modeling techniques to detect suspicious claims.

- Aetna. This healthcare company uses ML to analyze healthcare claims data and identify potential fraud. Their system uses NLP and predictive modeling to detect fraud patterns.

SoloWay developers can easily integrate ML algorithms into your business for any purpose.

Implementing Machine Learning for Fraud Detection: How SoloWay can help

SoloWay Technologies is a sophisticated development team that creates business solutions using machine learning algorithms. We provide a full range of ML services, including strategy development, analysis, requirements formalization, ML & AI implementation, and integration of AI- and ML-based applications. Our advantages:

- 20+ full-time data analysts, data engineers, and ML engineers

- 8+ years of practical knowledge of Data Engineering and NLP

- 25+ AI and ML projects completed

We work with frameworks for building, training, and implementing neural network models – Tensorflow, Keras, PyTorch, TFLite, and others. Feel free to contact us to incorporate cutting-edge technologies into your business!

Conclusion

It cannot be said that ML saves 100% from financial fraud. But with ML, you can significantly reduce the number of frauds and prevent such risks as abuses, direct losses on commissions, loss of reputation with the payment processor, loss of trust of your business clients, etc.

So if your company is still on the way to implementing ML solutions, we advise you not to waste time, as you can contact us right now.