People are gradually moving towards mobile payments using digital wallets. The global mobile payment market was valued at 1449.56 billion in 2020. Between 2021 and 2026, the number of mobile payments will grow with a CAGR of 24.5% and register a $5399.6 billion in value. Mobile wallets will reach 4.8 billion by 2025 and account for half of all eCommerce payments. This is why developing your own digital wallet is a perspective decision.

This article discusses examples of the most popular wallet apps, the top 5 must-have e-wallet features, and the popular technology stack used for digital wallet app development.

Key points

What is a digital wallet?

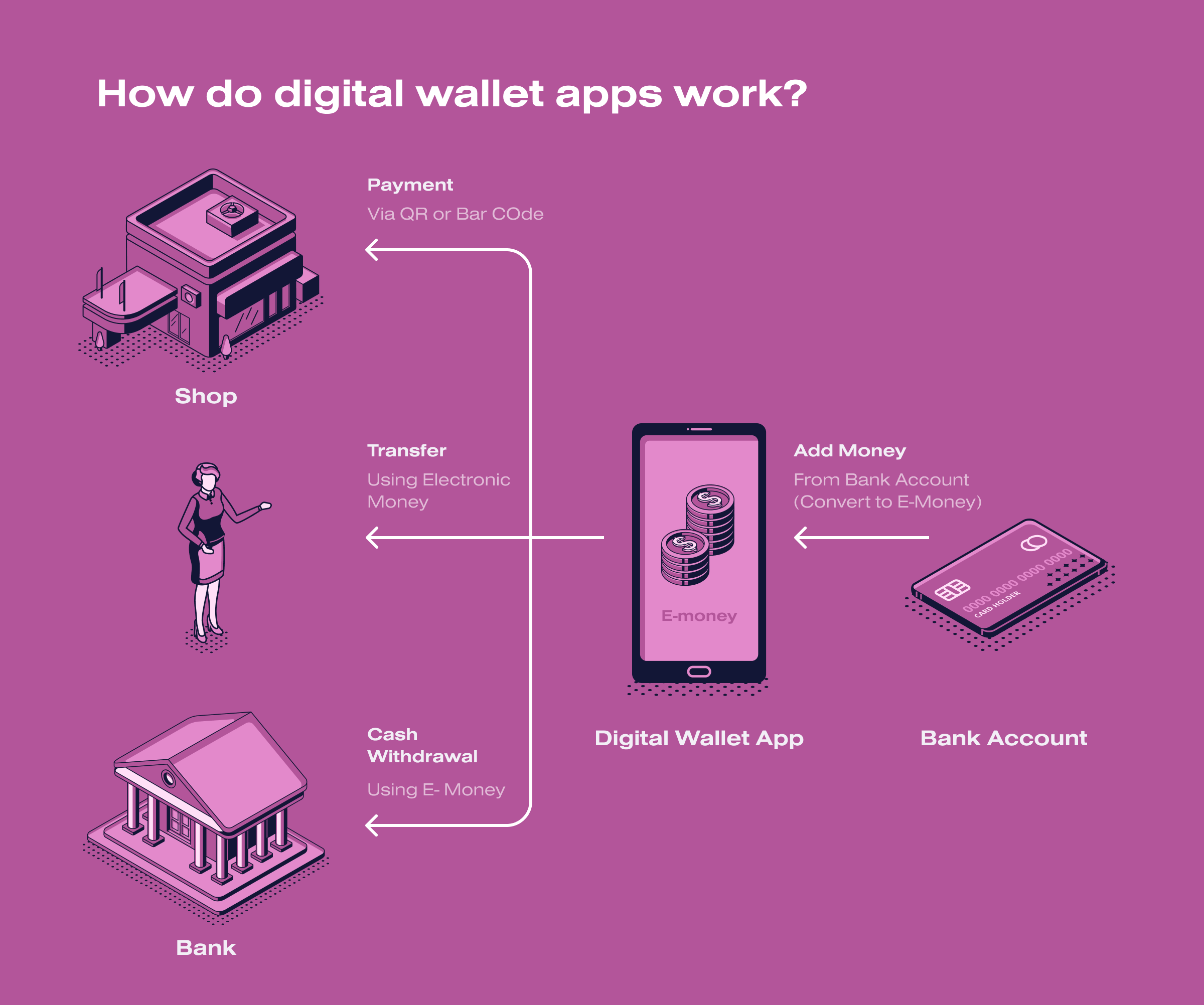

Digital wallet is a software for storing and managing financial resources such as money, payment cards, rewards programs, tickets, and other digital assets. Digital wallets provide a convenient way to make online payments, purchases, and fund transfers without physical cash.

Digital wallets can provide a variety of features, including:

- Storing payment information. Digital wallets can store data about bank, credit, and debit cards and other payment methods.

- Online payments. Users can use digital wallets to pay for goods and services online and transfer funds to other users.

- Accounts and balances. Digital wallets can track balances, transaction history, and payment status.

- Security. Many digital wallets provide security mechanisms such as two-factor authentication, biometric recognition (fingerprints, facial scans), and data encryption.

- Mobile apps. Many digital wallets have mobile apps that make accessing and managing funds from mobile devices easier.

Examples of popular digital wallets include PayPal, Apple Pay, Google Pay, Samsung Pay, Alipay, WeChat Pay, and many others. The available features and payment options may vary depending on the country and region.

Examples of the most popular wallet apps

Ten most popular digital wallets around the world include:

- Apple Pay. Apple’s digital wallet allows users to make payments using their Apple devices, including iPhones, iPads, and Apple Watches, both in-store and online.

- Google Pay. Google’s digital wallet offers similar functionality to Apple Pay, enabling users to make payments and manage loyalty cards through their Android devices.

- Samsung Pay. Samsung’s digital wallet is compatible with a wide range of Samsung devices and supports both NFC (Near Field Communication) and MST (Magnetic Secure Transmission) technologies for payments.

- Cash App. Developed by Square, Cash App lets users send and receive money, as well as invest in stocks and buy Bitcoin.

- Alipay. This widely used digital wallet in China offers various financial services, including payments, money transfers, and even investments.

- WeChat Pay. Integrated into the WeChat messaging app, WeChat Pay is another popular digital wallet in China, offering various payment and financial services.

- Paytm. This Indian digital wallet provides various services, including mobile recharges, bill payments, and online shopping, along with a digital payments platform.

- M-Pesa. Especially popular in parts of Africa, M-Pesa by Vodafone allows users to perform mobile money transfers and payments.

- GrabPay. Operating primarily in Southeast Asia, GrabPay is associated with the Grab ride-hailing service and offers various payment and financial services.

- LINE Pay. Associated with the LINE messaging app, LINE Pay is popular in Japan and offers payment and money transfer services.

As you can see, there are many digital wallets targeted at different regions.

How to create a digital wallet: 5 technical aspects

Embarking on the journey of mobile wallet development involves navigating a series of intricacies dictated by technical requisites. To engineer a soaring digital wallet, embracing these pivotal factors is imperative.

Adhering to legalities and standards

Conforming to regulatory frameworks is an unequivocal prerequisite for launching a digital wallet app. Vigilance against financial crimes, money laundering, and deficient user identity verification is paramount.

Adherence to KYC (Know Your Customer) and AML (Anti Money Laundering) regulations is non-negotiable for mobile wallet entities. Handling payment card data necessitates alignment with PCI DSS standards to avert potential fraud or data breaches.

Compliance with regulations like GDPR (General Data Protection Regulation in the EU) is mandatory regarding data privacy. GDPR sets benchmarks for collecting and processing personal data. It fortifies user information.

Furthermore, conscientious attention to local regulations is essential. U.S. operations entail adherence to the BSA, USA PATRIOT Act, and Dodd-Frank Acts. European counterparts must uphold GDPR, PSD2, and AMLD. An array of additional regulations and licensing accords might also be pertinent.

Elevating mobile wallet functionality

Ponder over this pivotal query: Does your solution transcend the ordinary? If the response veers towards negation, a profound reconsideration is warranted. Modern digital wallets must transcend rudimentary payment capabilities. The aspirational goal involves integrating a diverse array of functions into your application.

For instance, consider incorporating sophisticated budgeting tools. While transaction histories and adaptable payment modes suffice, why not elevate further? Empower users to establish personalized spending thresholds, with timely notifications as limits approach.

Another promising avenue entails furnishing exclusive offers tailored to users’ spending tendencies and inclinations. Given the proliferation of e-wallets, your solution’s distinctiveness becomes the bedrock for prevailing against competition.

Enabling data transfer technologies

This facet assumes pivotal significance within the realm of mobile wallet app development. E-wallets commonly harness these data transfer methodologies:

- NFC. This contactless technology facilitates swift transfers between smartphones and point-of-sale terminals. It outshines Bluetooth due to its rapid connection setup, requiring less than a tenth of a second. NFC is integral to contactless devices and RFID structures, primarily employed for card emulation, reading, and peer-to-peer modes.

- Bluetooth and iBeacon. iBeacon integrates radio beacons for non-contact data exchange while minimizing energy consumption. Devices emit uninterrupted signals intercepted by smartphones equipped with BLE compatibility within the transmission radius. Activating Bluetooth is essential to receive radio beacon signals. iBeacon empowers personalized e-wallet incentives in proximity to stores.

- QR code payments. As the nomenclature suggests, users scan QR codes from invoices using their smartphone camera and a scanner app. Subsequent steps involve transferring funds from a bank account, with transaction receipts dispatched via email. This method enjoys popularity and accessibility among most smartphone users.

In reshaping the discourse on building a dynamic digital wallet app, these technical dimensions forge the cornerstone of innovation and competitiveness.

Security measures

Undoubtedly, safeguarding funds against hacks or theft is paramount. Constructing a secure digital wallet hinges upon the integration of the following protective measures:

- Tokenization. The indispensable practice of tokenization erects a formidable barrier against sellers accessing sensitive card data during transactions. Rather than exposing the actual card details, this technology encrypts the information into a unique token. The resultant amalgamation of random symbols drastically diminishes the odds of unauthorized access. Unlike traditional encryption, tokenized data remains irreversibly concealed.

- P2PE (Point-to-Point Encryption). P2PE stands as a comprehensive defense mechanism, ensuring the entirety of a transaction remains securely encrypted. The instant cardholder information is input at the point of sale (PoS), and encryption is initiated. This protective cloak of encryption remains intact throughout the transaction lifecycle, culminating in the payment processing phase. The outcome is a significantly mitigated risk of data compromise, fortifying digital payments against leakage.

- Password protection. Time-tested and indispensable, password protection is the linchpin of any robust security infrastructure. However, developers can heighten its efficacy by implementing stringent password requirements. For instance, hacker-prone passwords are automatically rejected. The emphasis lies on crafting passwords of sufficient complexity to thwart breaches.

At SoloWay Tech, we can consult you regarding the best security measures for your e-wallet and even more.

Payment SDKs for e-wallets

Enabling payments from personal portable devices, software development kits (SDKs) stand as a pivotal innovation. These kits integrate card entry forms into mobile payment apps, generating tokens from card information or e-wallet apps.

Advantages of mobile SDKs:

- Simplified integration. SDKs streamline and optimize mobile wallet application development, offering pre-built functionalities.

- Enhanced security. Maintaining unwavering security and dependability throughout payment processing is crucial. In contrast to APIs, payment SDKs provide heightened reliability and protection.

- Economical advantages. Equipped with comprehensive SDKs, developers gain opportunities to reduce costs significantly.

Mobile SDKs are really useful when developing e-wallets.

Top 5 must-have e-wallet features

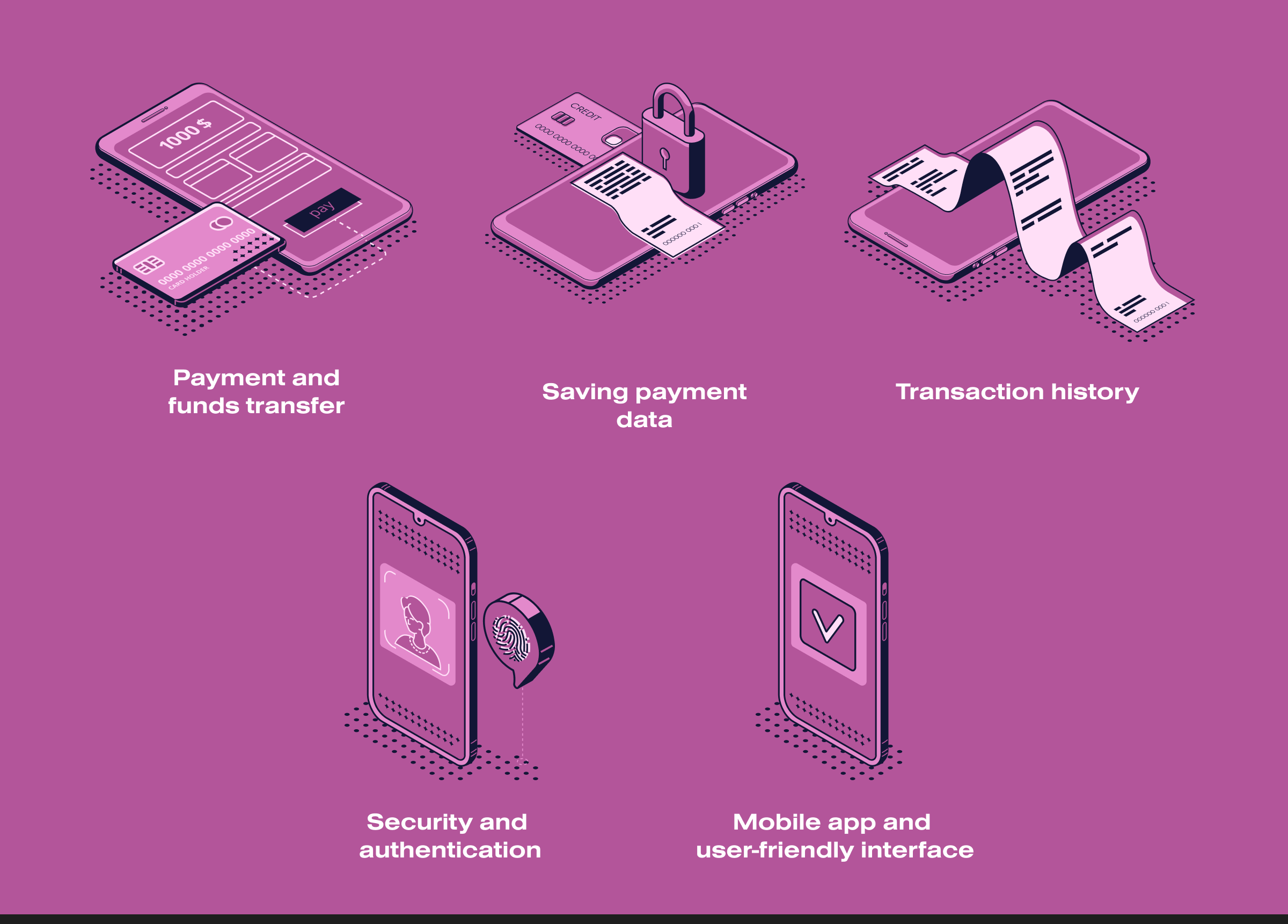

Digital wallets provide a convenient way to manage your finances and make online payments. Here are 5 must-have features you should have in a digital wallet:

- Payment and funds transfer. This is the primary function of the digital wallet. Users should be able to make online payments, transfer money to each other, pay for goods and services, and make cross-border transfers.

- Saving payment data. Digital wallet should be able to save payment data such as bank cards, bank accounts, and other payment methods. This allows users to make payments quickly and conveniently without entering data every time.

- Transaction history. The transaction history feature is vital for monitoring expenses and income. Users should have access to detailed information about every transaction made, including the amount, date, and location.

- Security and authentication. Protecting users’ financial data is a key aspect. Digital wallets should provide security mechanisms such as two-factor authentication, biometric identification (e.g. fingerprint or facial recognition), and data encryption.

- Mobile app and user-friendly interface. People should access your digital wallet via mobile apps on different platforms (iOS, Android, etc.). Easy navigation and ease of use contribute to a positive user experience.

In addition to these basic functions, digital wallets can provide additional features such as discounts and bonuses, integration with loyalty programs, currency exchange, and other services, depending on user needs and market requirements.

Popular technology stack used for digital wallet app development

Here, we have collected technologies that are used for digital wallet development.

| SMS, Voice, and Phone Verification | Nexmo |

| Payment | Braintree, PayPal, PayUMoney, Stripe |

| Front-End | Angular, Javascript, HTML5, CSS, Kotlin, Swift, Bootstrap, Vue.js, React.js |

| Backend | PHP, NodeJS, Python, Java |

| Database | HBase, MongoDB, Apache Cassandra, MySQL, Postgres |

| Cloud Environment | Google Cloud, Salesforce, Azure and AWS |

| Push Notifications | Push.IO, Twilio, Amazon SNS, Urban Airship, Google Firebase |

| Cross-Platform Framework | Ionic, React Native, Flutter, Xmarian |

| Real-Time Analytics | Big Data, Hadoop, Spark, Apache Kafka, Amazon Kinesis, Flink |

| QR Code Scanning | ZBar Code Reader, ByteScout BarCode |

Conclusion

The future of financial transactions is undeniably intertwined with the realm of digital wallets. The impressive trajectory of growth and innovation in this field promises enhanced convenience for users and remarkable business opportunities for those willing to embark on the journey of digital wallet development. As the world continues its march towards a cashless economy, digital wallets stand as beacons of financial evolution, redefining how we manage and engage with our finances in an increasingly interconnected digital landscape.