For an online store to function properly, it needs to have a payment gateway to accept quick payments from its customers. In 2023, eCommerce retail purchases are expected to rise from 14.1% to 22%. The payment gateway is in the interest of the online store`s owner to give customers as much freedom as possible to make payments.

In our article, you will find out what a payment gateway is and how it works. We’ll also discuss types of online payment gateways, how to choose a payment gateway provider, and how to integrate a payment gateway.

Key points

What is a payment gateway and how does it work?

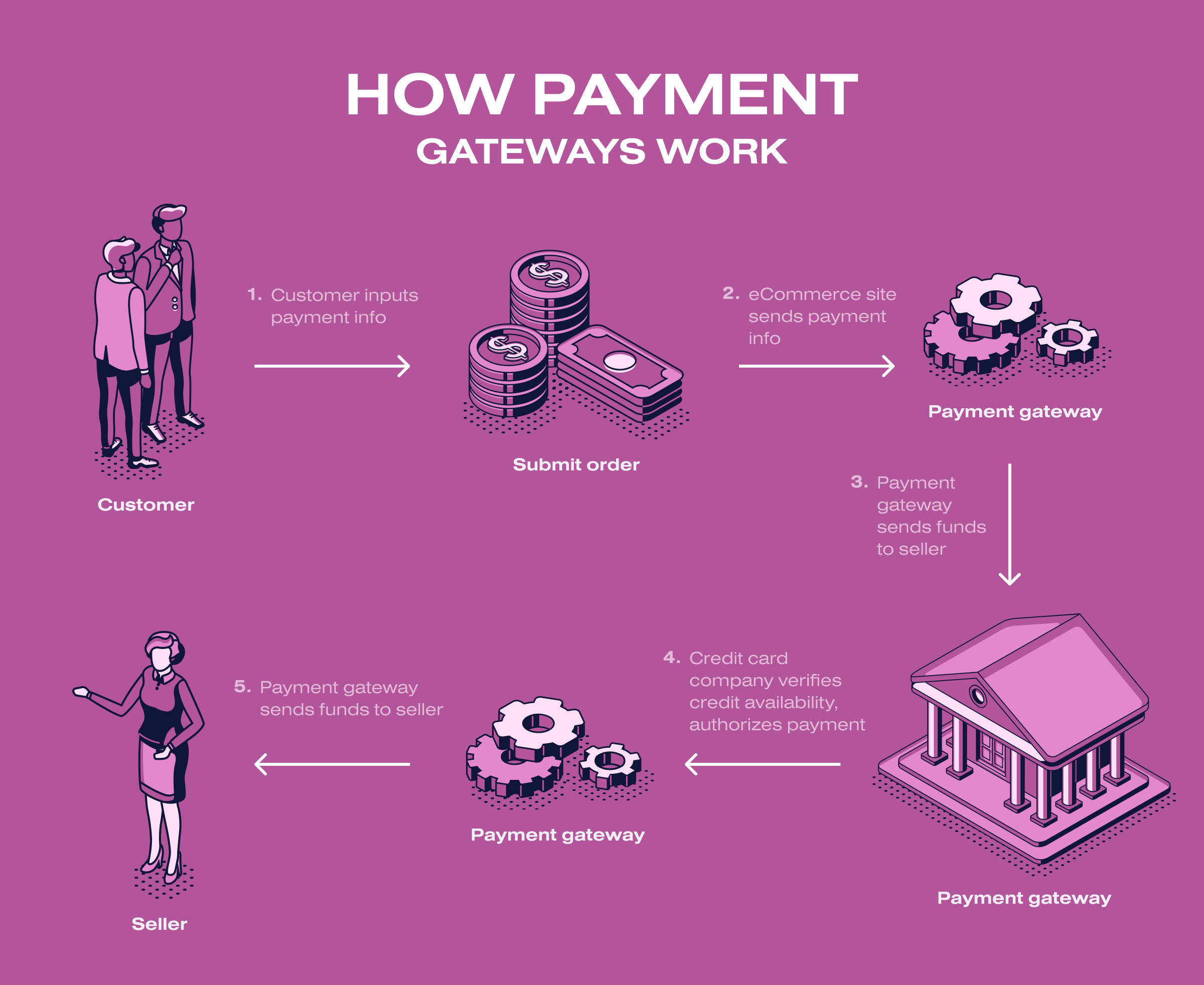

Payment gateway is a service that authorizes and processes payments in online and brick-and-mortar stores. The customer makes payments to the online store owner through the payment gateway. The payment gateway provider supplies clients with their preferred forms of payment. The number of options available depends on the particular payment gateway provider.

Cooperation with a payment gateway provider looks quite simple from the perspective of a person who manages his own store. Below we describe its entire process:

- Registration within the payment gateway provider`s website. There is still not much you can do on a freshly created account.

- Signing a contract with the payment gateway provider. This company determines all the terms and conditions of cooperation – primarily the financial ones.

- Integrating the payment gateway with the online store. Professionals should do it. SoloWay team has been doing this for years. We guarantee smooth payment gateway integration and trouble-free operation of the entire system, regardless of your payment gateway provider choice. Besides this, we can integrate the POS system into your website.

- Payment on the part of the customer. This payment can reach any form offered by the payment gateway provider.

- Confirmation of payment. The payment gateway provider informs the customer and the online store owner by e-mail that the former has passed the payment process correctly.

- Order processing and withdrawal of funds. The store owner immediately gains access to all the funds. He or she can dispose of them in any way.

An online payment gateway is one of the things that will not only make it easier for customers to finalize their orders. It’s also something that can convince them to make a purchase. Many people are the ones who look at the available forms of payment even before they make a purchase.

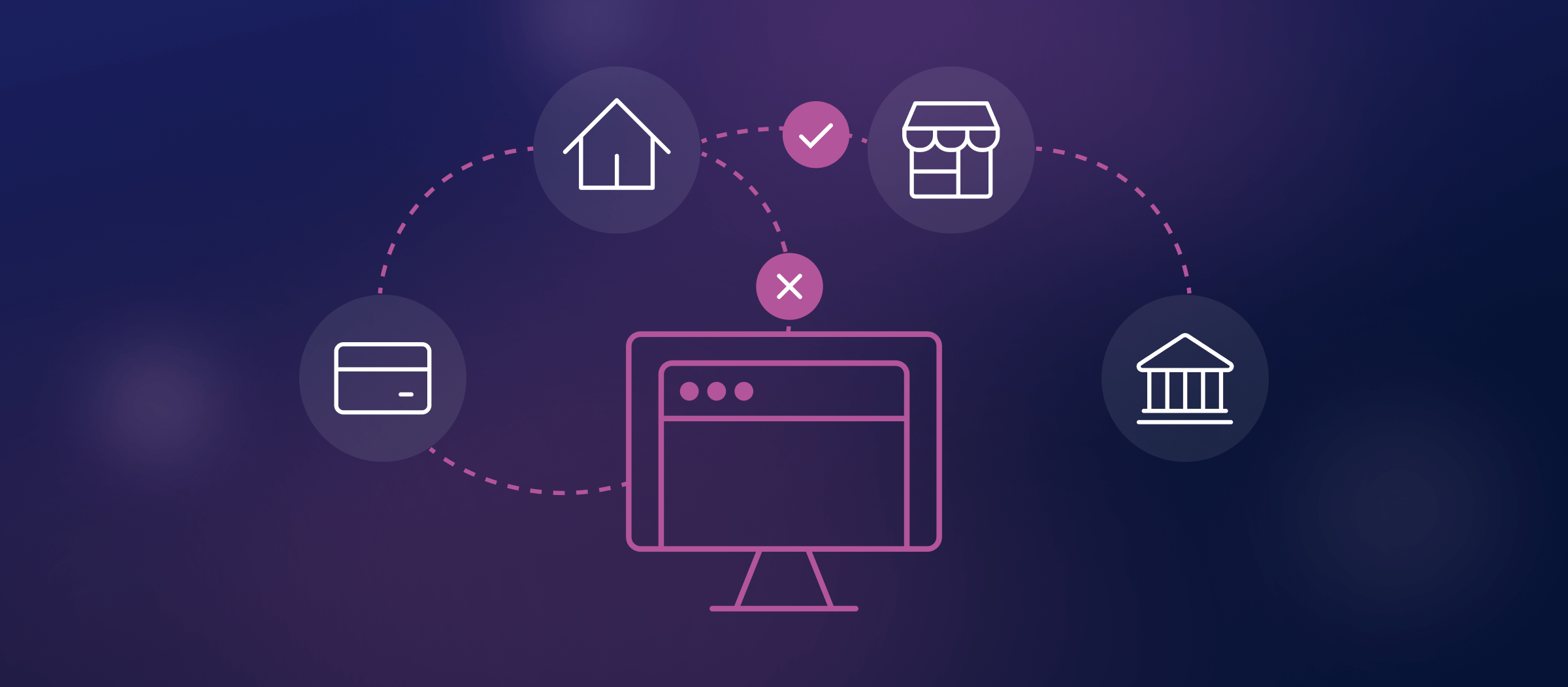

Types of online payment gateways

There are several types of payment gateways, each providing specific functionality and demanding a different approach to integration:

- Hosted payment gateway. An online shopper is redirected from the checkout page to the gateway provider’s website to finish the payment. After the payment, the online shopper is redirected back. Gateway provider handles payment processing and sensitive data.

- Direct post payment gateway. Online shoppers don’t need to leave a checkout page to finish a purchase. Sensitive data is immediately transferred from the back end to the gateways’ server for processing and storage.

- Self-hosted white-label payment gateway. A prebuilt gateway incorporates directly into the website or app using ready-to-use or custom APIs. The checkout procedure occurs within the website or app.

- Self-hosted custom payment gateway. A custom payment gateway incorporates straight into the website or app using custom APIs. The checkout procedure occurs within the website or app.

Payment gateways are currently a standard and something you should not forget about when launching your online store. If you haven’t integrated a payment gateway yet, it’s worth taking care of immediately.

How to choose a payment gateway provider?

It is very difficult to find a clear and correct answer to the question of what payment gateway provider to choose for your online store. There are many payment gateway providers. Their offers are incredibly diverse.

What attracts, by far, the most attention from online store owners is the commission. The smaller it is, the more significant part of each transaction will go into their pockets. Thus, the greater the profit will also be. However, the commission is not the only thing you must consider when choosing a payment gateway provider. You should also take into account:

- Individual approach. Many online payment gateway providers present a rigid price list. In their case, it is usually impossible to change, even for the largest customers. The best payment gateway providers offer a more individual approach. With them, the terms can be negotiated.

- Forms of payment offered. Not every online payment gateway provider gives access to the same payment methods. True, most of them give access to most banks.

- Trust in the market. A payment gateway provider is someone who can build the reputation of your online store. So it is worth betting on someone recognizable and presented everywhere, even at the expense of a higher commission.

It is possible to use the services of several different payment gateway providers. However, this requires signing several contracts and is usually not worthwhile. Especially since many operators oblige the seller to make a certain turnover through them, it is best to choose a payment gateway provider that is fully sufficient.

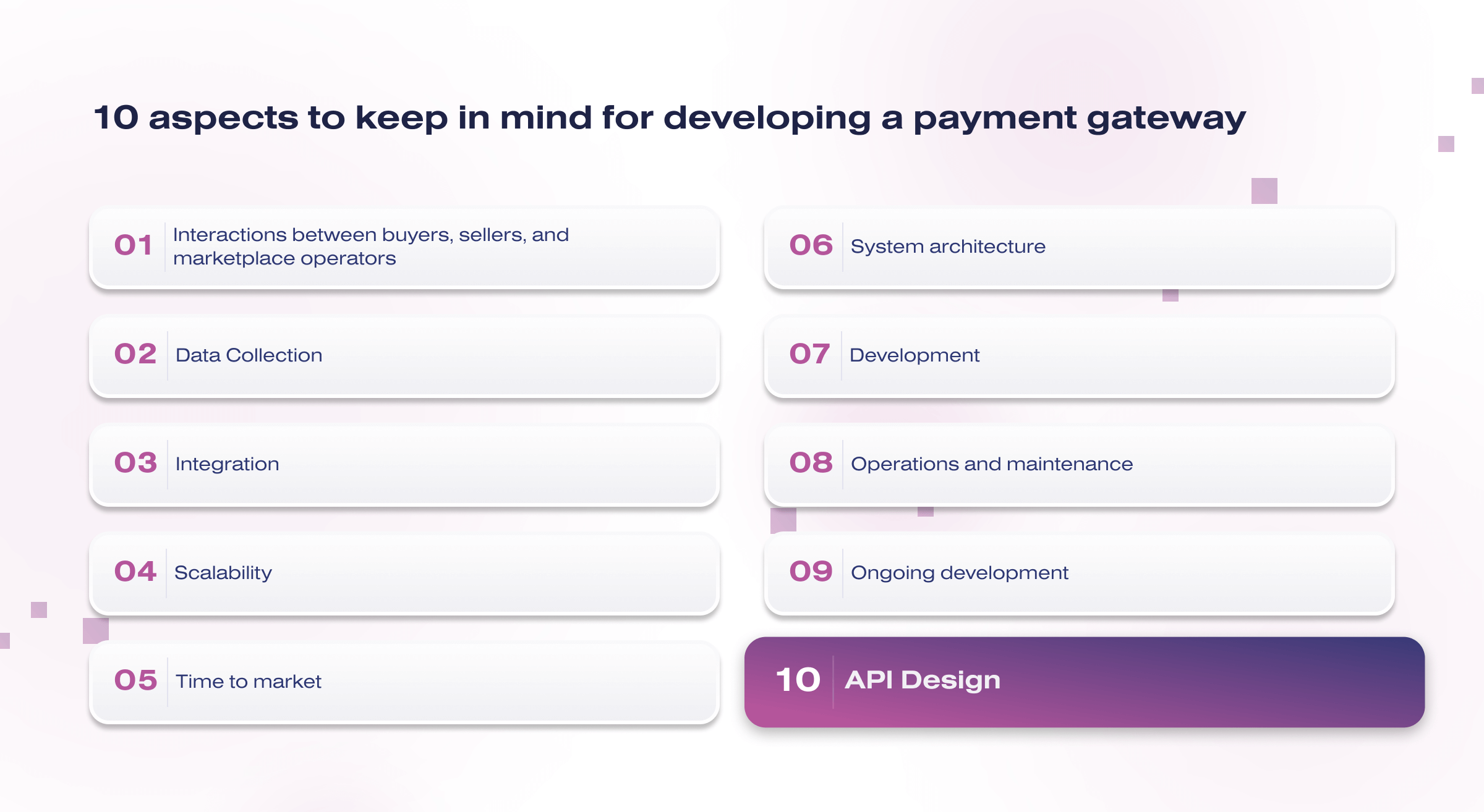

Is it possible to build a custom payment gateway?

Yes, it is possible to build a custom payment gateway. However, developing a reliable and secure payment processing system requires significant technical knowledge and resources. Building a custom payment gateway involves developing software that integrates with various payment networks, processing payments securely, and complying with industry regulations and security standards.

Before building a custom payment gateway, it is important to consider the costs and potential risks involved. Developing a custom payment gateway can be time-consuming and expensive, and there may be legal and regulatory barriers to overcome. Also, custom payment gateways may be less widely accepted than established ones, which could limit their usability for customers.

Suppose you decide to build a custom payment gateway. In that case, you should work with experienced e-commerce developers and security experts like the Soloway team to ensure the system is reliable, secure, and compliant with industry standards. Partnering with payment networks and financial institutions may also be necessary to ensure payments are processed efficiently and securely.

How to integrate a payment gateway

Integrating an online payment gateway involves connecting your website or application with a payment processing network that enables online payments. Here are the general steps for integrating the payment gateway:

- Choosing a payment gateway provider. Many payment gateway providers are available, each with different features, pricing, and payment gateway integration options.

- Registering your account. After selecting a provider, set up an account with them. This will involve providing some basic information about your business, bank account details, and other necessary documents.

- Obtaining API credentials. The payment gateway provider will provide you with API (Application Programming Interface) documentation and credentials (API keys, Merchant ID, Secret key) that you will need to connect your website or application with their payment gateway.

- Integrating the payment gateway via API. Once you have the necessary credentials, the development team can integrate the payment gateway API into your website or application’s checkout page or payment flow. This can be done using a software development kit (SDK) or through custom API integration.

- Testing and launching. After the integration, the development team thoroughly tests the payment gateway to ensure that it’s working correctly. It conducts a few test transactions to confirm that payments are being processed correctly.

- Maintaining and updating. You need to stay up-to-date with the latest version of the payment gateway’s API and make updates as necessary.

Failure to integrate your online store with an online payment gateway can take a heavy toll. The lack of such integration is a significant increase in shopping carts abandoned by customers. It also often generates invisible losses in the system.

Conclusion

You need to be aware of several things when running an online store. The most important is the saying, “our customer, our master”. It is also reflected in the context of the forms of payment you offer. These should be as many as possible. This is where the customer should have control and choice. The ideal way to provide more immediately is to use an online payment gateway. Moreover, this is something that customers expect from a decent online store.

Integrating a payment gateway will not only bring you customers. It will also be able to increase the trust in your online store. It will also make your profits soar, and you won’t have to worry about the financial layer of your online store. However, it’s worth analyzing the benefits given by each payment gateway provider and making an informed decision in this context.

When deciding on an integrating payment gateway, you must entrust this process to professionals who will take care of this for you and ensure everything works. We are that kind of company. One of our last great e-commerce projects was SOCAR’s digital commerce transformation. We will gladly take on the integration of your store with any online payment gateway.

Reach out to contact us today to learn more.